What once seemed unthinkable—even absurd—is now a growing reality. Indians long nestled in the abundant comforts of life abroad are actively seeking a way back home. A rising number of Non-Resident Indians (NRI) are eyeing a return— some by choice, others by necessity.

The motivations vary: pursuing entrepreneurial dreams in India’s thriving startup scene, raising children amid close family ties, or retiring comfortably with lower living costs and accessible healthcare. For others, the push comes from tougher visa regimes, onerous taxes, job insecurity, or soaring expenses overseas.

Also read | NRIs returning to India: Here's a checklist covering banks, MFs, foreign assets, PAN, Aadhaar, property for what you need to do

But for NRIs, moving back to India is more than just packing up and getting on a plane home. It is a life-altering event that stirs mixed emotions. Rebuilding life in India requires meticulous planning—navigating tax status changes, repatriating assets, switching jobs and bank relationships, shifting children to new schools. After years abroad, reintegrating into India’s social and cultural rhythms can be challenging too. Here’s how to start your journey back.

VIKRANT GUPTA, 40, New Delhi

Lived for 14 years in Australia

Returned in 2022

Reasons for shifting

Start own business, stay closer to parents.

His story

Also read | NRIs filing ITR in India should know these four income tax-related changes

Chart your own path

New Delhi-based investment professional Vikrant Gupta, 40, was apprehensive when he moved back in 2022 after 14 years in Australia. Earlier in 2018, he had taken a sabbatical from work for three months to explore the market scenario in India. What he discovered was a more vibrant, dynamic marketplace compared to the mature environs of Australia. The idea of a move back home to New Delhi seemed appealing. Being close to his parents was also a pull. A ready house awaited. Post-Covid, he decided to dip his feet into the water. Renu Maheshwari, Co-founder, Finscholarz Wealth Managers, observes, “Earlier, folks did not look back once migrated. Now, more conversations are happening around exploring a return.”

Also read | Income tax guide for NRIs returning to India from abroad: Here’s how to understand your tax liabilities for smoother transition

But starting an asset management business was not going to be easy. “India is a tough place to do business. I was also not sure whether I would re-adapt to the local lifestyle,” recounts Gupta. He had to do without any cash flow initially, but had enough savings to allow a runway of five years. A frugal, calculating lifestyle amid already low living costs proved supportive. After the initial two years putting together the pieces of his business and finding his feet, Gupta firmed the resolve to stay permanently in India by 2024. “After getting used to a certain quality of life abroad, India can prove a different society altogether. Settling in may take some time,” contends Gupta. “If you have an adaptive mindset, you will be fine,” he says.

After nearly 10 years in the US, Ronak Gala, 34, shifted back with his wife and two kids, aged 3 and 5 years, in December 2024. Initially planning only a short visit to India, the family made an impulsive call to make the trip an outright switch of residence. The move was prompted by a void—of not having family around. They identified and bought a house in a locality near both sets of parents in Mumbai.

How your residency status changes

Ronak continues to work remotely from home as a consultant for US clients, while his wife arranges for spiritual healing for individuals and corporate teams. Yet, Ronak and family are unconvinced about a long term stay in India. “We are still in the phase of discovery,” insists Ronak, acknowledging the shift in mentality needed to adjust to the new environment. Some aspects of life in India are overwhelming for the returning family, such as the traffic, pollution and littering. At the same time, seeing the kids happier around grandparents emboldens them to push on. Still, they have kept the door open for a return to the US. “Our longer term stay depends on the kids’ needs being met as also the social life we build,” Ronak mentions.

There is no single blueprint or playbook for NRIs contemplating a return. Everyone’s journey will be different—guided by personal circumstances and shaped by multiple variables.

Don’t simply try to ape others who have come before you. “What worked for your NRI friend or neighbour abroad may not work for you,” asserts Vishal Dhawan, Co-Founder, Plan Ahead Wealth Advisors.

Your approach must be tailored to your situation. Are you shifting for jobs, raising children or for retirement? “It is important that you work out why you want to move back, and not blindly copy others,” insists Gupta. Are you firm in your resolve to shift base permanently or are you testing the waters and keeping your options open?

A lot of the planning and moves that you make could vary depending on which side of the lens you are looking from.

Mind your tax residency status

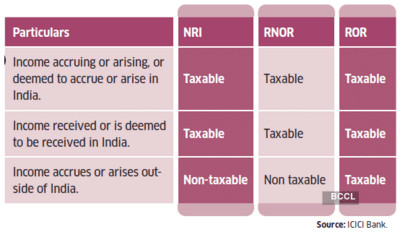

Your taxability depends on whether you qualify to be an RNOR or an ROR.

“If making it permanent, you will look to untangle much of what you did in your previous residency. But if you are unsure, you may want to do very little changes initially and later make bolder moves when you find your feet back home,” remarks Dhawan.

Bridging the divide

Lifestyle is an area where expectations can deviate from reality. Financial advisers and returning NRIs warn against equating the lifestyle abroad with what you’ll encounter back home. Don’t expect to immediately feel at home in your new surroundings. “Settling back in after so many years abroad will take time,” Gupta warns.

Aadam Mamaji, now 31, never planned to come back when he left for Canada at 18 years to pursue engineering. His plan was to put down roots for life. He even came close to buying his own house in Vancouver. But pangs of isolation and the feeling of hitting a ceiling at his job made him uneasy. Meanwhile, visits to his family back home in Mumbai revealed an aspirational, high-growth India that aroused FOMO, or the fear of missing out. A nudge from his family last year made him mull a switch, but it wasn’t a quick yes. Ultimately, the pull of family prevailed. While he misses the proximity to nature and the quality of life that Canada provides, he thrives in the luxuries India offers—easy availability of manpower, house help and professional services. It allows him to truly focus on his work. His advice to others: “If you keep expectations very high when you come back , you are setting yourself up for disappointment.”

Financially, things may look very different on the other side. Salaries on offer in India may be significantly lower. Even as cost of living is relatively modest, inflation is much higher, sending expenses soaring quickly. Experts insist that NRIs make necessary adjustments in their financial plan. “If you will be earning in rupees, your cash flows must be realigned and projections revised,” urges Tarun Birani, Founder, TBNG Capital Advisors. He advises parking at least 12-18 months’ equivalent of expenses in a contingency fund. If you are moving from a zero-tax jurisdiction like the UAE, your income profile will be very different in India, points out Dhawan. You may need to redo your financial plan accordingly.

RONAK GALA, 34, Mumbai

RONAK GALA, 34, Mumbai

Lived for 10 years in US

Returned in 2024`

Reason for shifting

To be closer to family.

His story

Make sure you map the broad contours of your financial plan well ahead of your move, experts say. Don’t defer this exercise until you plant roots firmly on new ground. Palak Chauhan, 37, left for the US with her husband soon after marriage in 2014. But she was always keen to return one day. After exploring all that the US has to offer, Chauhan now feels the time is right to return to her roots for good. She feels strongly about raising their five-year-old daughter closer to the doting grandparents, on a healthy diet of culture and values. With her toddler starting first grade next year, Chauhan feels the timing is right for a move—one that won’t put her in discomfort or upset her sense of belonging.

For the past one-and-a-half years, Chauhan has been shuttling between the US and India, setting up her own financial planning platform. Her husband—a CFA and investment banker—is exploring the best way to move to India. She acknowledges that they won’t be able to match their US income in India. But what makes her confident about making this move is a strong grip on the family’s finances. “We have worked out the math. Our calculations give us the comfort to go back and pursue different career paths without worrying about day-to-day expenses,” Chauhan asserts.

Changing tax residency

To make the right moves, understand how your residency status evolves. Timing your return to India is key to enjoying certain privileges associated with being an NRI for an extended time period. NRIs returning to India permanently don’t immediately gain the privileges of a typical resident. They first lose their NRI status depending on the total time spent in India during the year of their return. “Don’t assume tax residency right away. Your intention to stay permanently must be established first,” observes Birani. The moment you land on Indian soil, you may become resident under FEMA (Foreign Exchange Management Act), but your NRI status changes based on the number of days spent in India, says Dilshad Billimoria, Principal Advisor, Dilzer Consultants. If you return after October in a given financial year, you still qualify as an NRI for that year as you will be staying for less than 182 days in India. If you return before October, you become a resident in the same year.

But even after shedding the NRI status, your residency status will initially shift to Resident but Not Ordinarily Resident (RNOR) and later to Resident and Ordinarily Resident (ROR). An individual is considered RNOR if:

Once you become a ‘Resident’, you are liable to pay tax on global income and must comply with enhanced disclosure and regulatory requirements. For instance, any income earned from a property abroad or through pension from investments like 401(k), is taxable in India after you become a resident Indian.

What to do with your existing NRI deposits

File your income tax return as a resident Indian for the next assessment year. Disclose all foreign assets, accounts, and financial interests in Schedule FA of your income tax return, insists Gaurav Jain, Partner, Direct Tax, Forvis Mazars. Even after becoming an ordinary resident, you can claim relief from taxation in specific instances. You can benefit from the Double Tax Avoidance Agreement that India has with over 75 countries globally. Obtain a Tax Residency Certificate (TRC) if required to claim DTAA benefits. “To avoid double taxation, DTAAs must be effectively utilised, and any foreign tax credit must be documented and reported through Form 67,” Jain says.

Maintain detailed documentation related to foreign tax credits, offshore investments, and overseas income sources. “Noncompliance with these requirements, particularly the non-disclosure of foreign assets or income, can invite serious consequences under the Black Money Act, 2015, including steep penalties and prosecution,” Jain cautions.

How much to pack?

If you plan to sell assets you own abroad and repatriate proceeds to India, it is advisable to do so before your status changes to ROR. “Use the RNOR window to transfer your financial assets to India in a phased manner to claim tax exemption and offset against tax already paid overseas,” suggests Billimoria. There is no limit on the amount of money that can be received from abroad for personal reasons.

However, experts suggest asset transfer based on personal needs. Maheshwari says, “Don’t be in a rush to bring back foreign assets, in case you change your mind about taking permanent residency.” Move the assets gradually over 3-5 years as you find your feet in India, she suggests. Gupta did exactly that. He initially brought in 20% of his foreign assets from Australia, and has now transferred around 40%. Gala, on the other hand, has retained most of his US dollar assets as the family figures out if they intend staying for longer.

Financial advisers also suggest retaining assets in the foreign country for any planned dollar expenses. Hemant Beniwal, Principal Financial Planner, Ark Financial Planners, says, “Those who plan to send kids abroad for education should continue to hold dollar assets.” He suggests cleaning the slate if assets held abroad are modest, unless you are keen to have some exposure to global assets. Sreepriya N.S., Co-founder and Director, Entrust Family Office, suggests retaining a portion of foreign assets as insulation against local currency depreciation. “Maintaining diversified asset allocation is a must. Keep in mind that LRS restrictions will kick in if you reinvest money overseas later,” she adds. Also, remain vigilant about inheritance laws, which may differ for every country. The UK, for instance, has recently revamped its tax laws, with inheritance tax moving from a domicile-based to a residence-based system.

Putting down your roots

Returning NRIs often drop anchor immediately after landing in India. While there are some boxes you must tick right away, buying a house should not be a priority, insist experts. “Take your time before putting money down on the new house,” urges Maheshwari. “You may find the locality doesn’t suit your tastes or is inconvenient.” If you have the option of staying at an ancestral property, take it until you can identify a suitable location, she says. Finding a suitable school for the kids is also a big piece of the puzzle.

PALAK CHAUHAN, 37, US

PALAK CHAUHAN, 37, US

Living in US since 2014

Plans to move to India this year

Reasons for move

Raising children closer to their grandparents.

Her story

DILSHAD BILLIMORIA PRINCIPAL ADVISOR, DILZER CONSULTANTS

DILSHAD BILLIMORIA PRINCIPAL ADVISOR, DILZER CONSULTANTS

Note:“Use the RNOR window to transfer your financial assets to India in a phased manner to claim tax exemption and offset against tax already paid overseas.”

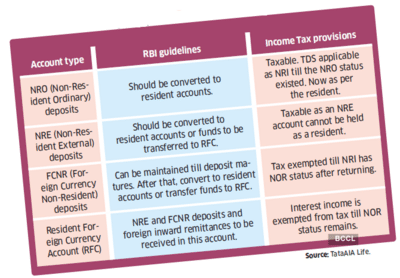

NRI returnees must prioritise a few things within a few days of turning resident. Get in touch with your banker and convert your NRE (Non-Resident External)/NRO (Non-Resident Ordinary) accounts to a resident savings account, or close them as per RBI guidelines. “Move funds from NRE, FCNR (Foreign Currency Non-Resident), NRO to local accounts to avoid tax leakages,” Birani says. You can, however, continue to hold your FCNR (B) fixed deposits until maturity. Post that, you will have to convert it into a resident rupee deposit account (maintained in local currency) or a resident foreign currency (RFC) account if you wish to continue holding the foreign currency.

VISHAL DHAWAN

VISHAL DHAWAN

CO-FOUNDER, PLAN AHEAD WEALTH ADVISORS

Note:“if you are unsure, you may want to do very little changes initially and later make bolder moves when you find your feet back home.”

Update KYC details in all Indian bank accounts with residential status. If you are holding an NRE FD, it would be converted into a domestic resident FD account, for the same promised rate of interest. “You may continue to hold the NRE FD, but the interest earned would become taxable as per your income tax slab,” points out Beniwal.

Next, update your residency status and KYC with asset management companies and stock broker. If you have invested stocks under NRI status, you need to close your portfolio investment services (PIS) account and open a normal brokerage or Demat account. Further, get your nominations done across all investments at the earliest. Secure your insurance coverage. “The insurance policy bought in a foreign country will not cover you in India. Buy comprehensive health and life coverage for you and your family,” Dhawan asserts. Finally, make a will locally even if you had made one previously. Wills executed in foreign jurisdictions will not apply in India, Birani points out.

The decision to return is complex. Plan ahead and consult with financial experts well-versed in both the financial landscapes of India and the country of your residence. Be prepared for a settling in period for you and your family.

AADAM MAMAJI, 31, Mumbai

AADAM MAMAJI, 31, Mumbai

Lived for 12 years in Canada

Returned in 2024

Reasons for move

To be part of a growing Indian economy.

His story

The motivations vary: pursuing entrepreneurial dreams in India’s thriving startup scene, raising children amid close family ties, or retiring comfortably with lower living costs and accessible healthcare. For others, the push comes from tougher visa regimes, onerous taxes, job insecurity, or soaring expenses overseas.

Also read | NRIs returning to India: Here's a checklist covering banks, MFs, foreign assets, PAN, Aadhaar, property for what you need to do

But for NRIs, moving back to India is more than just packing up and getting on a plane home. It is a life-altering event that stirs mixed emotions. Rebuilding life in India requires meticulous planning—navigating tax status changes, repatriating assets, switching jobs and bank relationships, shifting children to new schools. After years abroad, reintegrating into India’s social and cultural rhythms can be challenging too. Here’s how to start your journey back.

VIKRANT GUPTA, 40, New Delhi

Lived for 14 years in Australia

Returned in 2022

Reasons for shifting

Start own business, stay closer to parents.

His story

- Spent initial two years figuring out local life and setting up the business.

- Frugal lifestyle and long runway of savings helped.

Also read | NRIs filing ITR in India should know these four income tax-related changes

Chart your own path

New Delhi-based investment professional Vikrant Gupta, 40, was apprehensive when he moved back in 2022 after 14 years in Australia. Earlier in 2018, he had taken a sabbatical from work for three months to explore the market scenario in India. What he discovered was a more vibrant, dynamic marketplace compared to the mature environs of Australia. The idea of a move back home to New Delhi seemed appealing. Being close to his parents was also a pull. A ready house awaited. Post-Covid, he decided to dip his feet into the water. Renu Maheshwari, Co-founder, Finscholarz Wealth Managers, observes, “Earlier, folks did not look back once migrated. Now, more conversations are happening around exploring a return.”

Also read | Income tax guide for NRIs returning to India from abroad: Here’s how to understand your tax liabilities for smoother transition

But starting an asset management business was not going to be easy. “India is a tough place to do business. I was also not sure whether I would re-adapt to the local lifestyle,” recounts Gupta. He had to do without any cash flow initially, but had enough savings to allow a runway of five years. A frugal, calculating lifestyle amid already low living costs proved supportive. After the initial two years putting together the pieces of his business and finding his feet, Gupta firmed the resolve to stay permanently in India by 2024. “After getting used to a certain quality of life abroad, India can prove a different society altogether. Settling in may take some time,” contends Gupta. “If you have an adaptive mindset, you will be fine,” he says.

After nearly 10 years in the US, Ronak Gala, 34, shifted back with his wife and two kids, aged 3 and 5 years, in December 2024. Initially planning only a short visit to India, the family made an impulsive call to make the trip an outright switch of residence. The move was prompted by a void—of not having family around. They identified and bought a house in a locality near both sets of parents in Mumbai.

How your residency status changes

Ronak continues to work remotely from home as a consultant for US clients, while his wife arranges for spiritual healing for individuals and corporate teams. Yet, Ronak and family are unconvinced about a long term stay in India. “We are still in the phase of discovery,” insists Ronak, acknowledging the shift in mentality needed to adjust to the new environment. Some aspects of life in India are overwhelming for the returning family, such as the traffic, pollution and littering. At the same time, seeing the kids happier around grandparents emboldens them to push on. Still, they have kept the door open for a return to the US. “Our longer term stay depends on the kids’ needs being met as also the social life we build,” Ronak mentions.

There is no single blueprint or playbook for NRIs contemplating a return. Everyone’s journey will be different—guided by personal circumstances and shaped by multiple variables.

Don’t simply try to ape others who have come before you. “What worked for your NRI friend or neighbour abroad may not work for you,” asserts Vishal Dhawan, Co-Founder, Plan Ahead Wealth Advisors.

Your approach must be tailored to your situation. Are you shifting for jobs, raising children or for retirement? “It is important that you work out why you want to move back, and not blindly copy others,” insists Gupta. Are you firm in your resolve to shift base permanently or are you testing the waters and keeping your options open?

A lot of the planning and moves that you make could vary depending on which side of the lens you are looking from.

Mind your tax residency status

Your taxability depends on whether you qualify to be an RNOR or an ROR.

“If making it permanent, you will look to untangle much of what you did in your previous residency. But if you are unsure, you may want to do very little changes initially and later make bolder moves when you find your feet back home,” remarks Dhawan.

Bridging the divide

Lifestyle is an area where expectations can deviate from reality. Financial advisers and returning NRIs warn against equating the lifestyle abroad with what you’ll encounter back home. Don’t expect to immediately feel at home in your new surroundings. “Settling back in after so many years abroad will take time,” Gupta warns.

Aadam Mamaji, now 31, never planned to come back when he left for Canada at 18 years to pursue engineering. His plan was to put down roots for life. He even came close to buying his own house in Vancouver. But pangs of isolation and the feeling of hitting a ceiling at his job made him uneasy. Meanwhile, visits to his family back home in Mumbai revealed an aspirational, high-growth India that aroused FOMO, or the fear of missing out. A nudge from his family last year made him mull a switch, but it wasn’t a quick yes. Ultimately, the pull of family prevailed. While he misses the proximity to nature and the quality of life that Canada provides, he thrives in the luxuries India offers—easy availability of manpower, house help and professional services. It allows him to truly focus on his work. His advice to others: “If you keep expectations very high when you come back , you are setting yourself up for disappointment.”

Financially, things may look very different on the other side. Salaries on offer in India may be significantly lower. Even as cost of living is relatively modest, inflation is much higher, sending expenses soaring quickly. Experts insist that NRIs make necessary adjustments in their financial plan. “If you will be earning in rupees, your cash flows must be realigned and projections revised,” urges Tarun Birani, Founder, TBNG Capital Advisors. He advises parking at least 12-18 months’ equivalent of expenses in a contingency fund. If you are moving from a zero-tax jurisdiction like the UAE, your income profile will be very different in India, points out Dhawan. You may need to redo your financial plan accordingly.

RONAK GALA, 34, Mumbai

RONAK GALA, 34, Mumbai Lived for 10 years in US

Returned in 2024`

Reason for shifting

To be closer to family.

His story

- Initially planning only a short trip, decided to switch residency outright.

- Bought house close to parents’.

- Still settling in, has kept doors open for a return

Make sure you map the broad contours of your financial plan well ahead of your move, experts say. Don’t defer this exercise until you plant roots firmly on new ground. Palak Chauhan, 37, left for the US with her husband soon after marriage in 2014. But she was always keen to return one day. After exploring all that the US has to offer, Chauhan now feels the time is right to return to her roots for good. She feels strongly about raising their five-year-old daughter closer to the doting grandparents, on a healthy diet of culture and values. With her toddler starting first grade next year, Chauhan feels the timing is right for a move—one that won’t put her in discomfort or upset her sense of belonging.

For the past one-and-a-half years, Chauhan has been shuttling between the US and India, setting up her own financial planning platform. Her husband—a CFA and investment banker—is exploring the best way to move to India. She acknowledges that they won’t be able to match their US income in India. But what makes her confident about making this move is a strong grip on the family’s finances. “We have worked out the math. Our calculations give us the comfort to go back and pursue different career paths without worrying about day-to-day expenses,” Chauhan asserts.

Changing tax residency

To make the right moves, understand how your residency status evolves. Timing your return to India is key to enjoying certain privileges associated with being an NRI for an extended time period. NRIs returning to India permanently don’t immediately gain the privileges of a typical resident. They first lose their NRI status depending on the total time spent in India during the year of their return. “Don’t assume tax residency right away. Your intention to stay permanently must be established first,” observes Birani. The moment you land on Indian soil, you may become resident under FEMA (Foreign Exchange Management Act), but your NRI status changes based on the number of days spent in India, says Dilshad Billimoria, Principal Advisor, Dilzer Consultants. If you return after October in a given financial year, you still qualify as an NRI for that year as you will be staying for less than 182 days in India. If you return before October, you become a resident in the same year.

But even after shedding the NRI status, your residency status will initially shift to Resident but Not Ordinarily Resident (RNOR) and later to Resident and Ordinarily Resident (ROR). An individual is considered RNOR if:

- He has been a non-resident Indian in 9 out of 10 years preceding that year; or

- He has been in India for a period of 729 days or less during the preceding 7 years.

Once you become a ‘Resident’, you are liable to pay tax on global income and must comply with enhanced disclosure and regulatory requirements. For instance, any income earned from a property abroad or through pension from investments like 401(k), is taxable in India after you become a resident Indian.

What to do with your existing NRI deposits

File your income tax return as a resident Indian for the next assessment year. Disclose all foreign assets, accounts, and financial interests in Schedule FA of your income tax return, insists Gaurav Jain, Partner, Direct Tax, Forvis Mazars. Even after becoming an ordinary resident, you can claim relief from taxation in specific instances. You can benefit from the Double Tax Avoidance Agreement that India has with over 75 countries globally. Obtain a Tax Residency Certificate (TRC) if required to claim DTAA benefits. “To avoid double taxation, DTAAs must be effectively utilised, and any foreign tax credit must be documented and reported through Form 67,” Jain says.

Maintain detailed documentation related to foreign tax credits, offshore investments, and overseas income sources. “Noncompliance with these requirements, particularly the non-disclosure of foreign assets or income, can invite serious consequences under the Black Money Act, 2015, including steep penalties and prosecution,” Jain cautions.

How much to pack?

If you plan to sell assets you own abroad and repatriate proceeds to India, it is advisable to do so before your status changes to ROR. “Use the RNOR window to transfer your financial assets to India in a phased manner to claim tax exemption and offset against tax already paid overseas,” suggests Billimoria. There is no limit on the amount of money that can be received from abroad for personal reasons.

However, experts suggest asset transfer based on personal needs. Maheshwari says, “Don’t be in a rush to bring back foreign assets, in case you change your mind about taking permanent residency.” Move the assets gradually over 3-5 years as you find your feet in India, she suggests. Gupta did exactly that. He initially brought in 20% of his foreign assets from Australia, and has now transferred around 40%. Gala, on the other hand, has retained most of his US dollar assets as the family figures out if they intend staying for longer.

Financial advisers also suggest retaining assets in the foreign country for any planned dollar expenses. Hemant Beniwal, Principal Financial Planner, Ark Financial Planners, says, “Those who plan to send kids abroad for education should continue to hold dollar assets.” He suggests cleaning the slate if assets held abroad are modest, unless you are keen to have some exposure to global assets. Sreepriya N.S., Co-founder and Director, Entrust Family Office, suggests retaining a portion of foreign assets as insulation against local currency depreciation. “Maintaining diversified asset allocation is a must. Keep in mind that LRS restrictions will kick in if you reinvest money overseas later,” she adds. Also, remain vigilant about inheritance laws, which may differ for every country. The UK, for instance, has recently revamped its tax laws, with inheritance tax moving from a domicile-based to a residence-based system.

Putting down your roots

Returning NRIs often drop anchor immediately after landing in India. While there are some boxes you must tick right away, buying a house should not be a priority, insist experts. “Take your time before putting money down on the new house,” urges Maheshwari. “You may find the locality doesn’t suit your tastes or is inconvenient.” If you have the option of staying at an ancestral property, take it until you can identify a suitable location, she says. Finding a suitable school for the kids is also a big piece of the puzzle.

Living in US since 2014

Plans to move to India this year

Reasons for move

Raising children closer to their grandparents.

Her story

- Timing her move so that it aligns with daughter’s move to First Grade.

- Shuttling between the two countries for the past 18 months, setting up her business.

- Confidence in own finances lends comfort to return.

Note:“Use the RNOR window to transfer your financial assets to India in a phased manner to claim tax exemption and offset against tax already paid overseas.”

NRI returnees must prioritise a few things within a few days of turning resident. Get in touch with your banker and convert your NRE (Non-Resident External)/NRO (Non-Resident Ordinary) accounts to a resident savings account, or close them as per RBI guidelines. “Move funds from NRE, FCNR (Foreign Currency Non-Resident), NRO to local accounts to avoid tax leakages,” Birani says. You can, however, continue to hold your FCNR (B) fixed deposits until maturity. Post that, you will have to convert it into a resident rupee deposit account (maintained in local currency) or a resident foreign currency (RFC) account if you wish to continue holding the foreign currency.

VISHAL DHAWAN

VISHAL DHAWAN CO-FOUNDER, PLAN AHEAD WEALTH ADVISORS

Note:“if you are unsure, you may want to do very little changes initially and later make bolder moves when you find your feet back home.”

Update KYC details in all Indian bank accounts with residential status. If you are holding an NRE FD, it would be converted into a domestic resident FD account, for the same promised rate of interest. “You may continue to hold the NRE FD, but the interest earned would become taxable as per your income tax slab,” points out Beniwal.

Next, update your residency status and KYC with asset management companies and stock broker. If you have invested stocks under NRI status, you need to close your portfolio investment services (PIS) account and open a normal brokerage or Demat account. Further, get your nominations done across all investments at the earliest. Secure your insurance coverage. “The insurance policy bought in a foreign country will not cover you in India. Buy comprehensive health and life coverage for you and your family,” Dhawan asserts. Finally, make a will locally even if you had made one previously. Wills executed in foreign jurisdictions will not apply in India, Birani points out.

The decision to return is complex. Plan ahead and consult with financial experts well-versed in both the financial landscapes of India and the country of your residence. Be prepared for a settling in period for you and your family.

Lived for 12 years in Canada

Returned in 2024

Reasons for move

To be part of a growing Indian economy.

His story

- Never planned to come back initially.

- Feeling of isolation, pull of family prompted move.

- Now adds value to wealth management business alongside his mother.

You may also like

Delhi–Goa IndiGo Flight Makes Emergency Landing At CSMIA After Mid-Air Engine Failure: Sources

FIFA 'consider scrapping penalty rebounds' and two more radical changes at 2026 World Cup

MGM Medical College -Linked Government Hospitals Lead In Plastic Surgeries Across MP

Guwahati Politics: Rahul Gandhi Vows To Jail Himanta, CM Hits Back Citing Bail Cases

Stranger Things fans 'work out' iconic guest star's role as they predict major showdown