Gurugram-based Karan Kumar is a sales manager and doesn’t pay a very high tax because his income is modest. He has opted for the new tax regime, which is a good decision as he does not claim too many tax deductions. Even if his company rejigs his pay structure to include some of the tax-friendly perks, he will still pay a higher tax in the old regime.

Under the new tax regime, there are no tax deductions and exemptions, but the standard deduction is higher at Rs.75,000 and the tax slabs are wider, with lower rates. Sudhir Kaushik of TaxSpanner believes that there is room for further tax savings in the new regime if Kumar asks his employer to offer the NPS benefit.

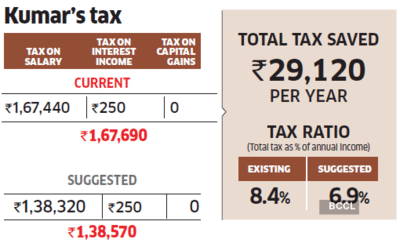

Under Section 80CCD(2), up to 14% of the basic salary allocated to the NPS by the employer is tax-free. If his company puts 14% of his basic income in the NPS, the monthly contribution will be Rs.11,666, and the annual contribution of Rs.1.4 lakh will cut his tax by around Rs.29,000.

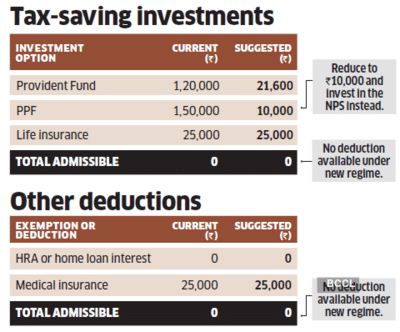

The contribution to the NPS will reduce his monthly take-home salary. However, it will not affect his overall liquidity if he reduces the contribution to the Public Provident Fund. Right now, Kumar puts Rs.1.5 lakh in the PPF each year, which does not fetch any tax benefit under the new tax regime. He should reduce this amount to Rs.10,000 a year and channelise the remaining Rs.1.4 lakh to the NPS.

He should also continue with his health and life insurance plan despite no tax benefits in the new regime.

WRITE TO US FOR HELP

Paying too much tax? Write to us at etwealth@ timesofindia.com with ‘Optimise my tax’ as the subject. Our experts will tell you how to reduce your tax by rejigging your pay and investments.

(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com)

Under the new tax regime, there are no tax deductions and exemptions, but the standard deduction is higher at Rs.75,000 and the tax slabs are wider, with lower rates. Sudhir Kaushik of TaxSpanner believes that there is room for further tax savings in the new regime if Kumar asks his employer to offer the NPS benefit.

Under Section 80CCD(2), up to 14% of the basic salary allocated to the NPS by the employer is tax-free. If his company puts 14% of his basic income in the NPS, the monthly contribution will be Rs.11,666, and the annual contribution of Rs.1.4 lakh will cut his tax by around Rs.29,000.

The contribution to the NPS will reduce his monthly take-home salary. However, it will not affect his overall liquidity if he reduces the contribution to the Public Provident Fund. Right now, Kumar puts Rs.1.5 lakh in the PPF each year, which does not fetch any tax benefit under the new tax regime. He should reduce this amount to Rs.10,000 a year and channelise the remaining Rs.1.4 lakh to the NPS.

He should also continue with his health and life insurance plan despite no tax benefits in the new regime.

WRITE TO US FOR HELP

Paying too much tax? Write to us at etwealth@ timesofindia.com with ‘Optimise my tax’ as the subject. Our experts will tell you how to reduce your tax by rejigging your pay and investments.

(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com)

You may also like

People with poor eyesight could be getting £749 every month

Lupita Nyong'o reveals secret decade-long health battle in candid post

Stranger Things fans 'work out' beloved 80s star's role as they predict major showdown

'Horrific and disturbing': California couple lock 20 children in 'hotel-like mansion', all born through surrogate mothers

2026 FIFA World Cup's contingency plans for wildfire smoke remain unclear