What is cost inflation index?

With each passing year, the cost of goods and services keeps increasing due to inflation. This reduces the purchasing power of money, which means that one can buy fewer things with the same amount of money. Cost inflation index is a tool, defined under Section 48 of the Income Tax Act, 1961, that helps measure the rise in cost due to inflation. It does so by assigning an index figure for each year.

The base year considered for the index is 2001-2, for which the figure is 100. All subsequent years’ index figure is calculated with respect to 100. The Central Board of Direct Taxes (CBDT) notifies this figure each year and publishes it in the official gazette. For 2025-26, the CBDT has notified the CII figure as 376.

What is it used for?

This index is used in taxation to avail of the indexation benefit. This means that while calculating the long-term capital gains, the purchase price of assets is increased to keep it in line with inflation. This reduces the gains and, thereby, the tax liability.

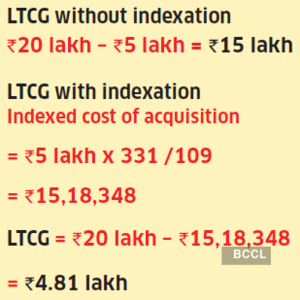

For instance, if you bought a house in 2003 for Rs.5 lakh and sold it in 2022 for Rs.20 lakh, here’s how you can calculate your long-term gain with and without indexation. For LTCG with indexation, you will first have to calculate the indexed cost of buying the property by using the following formula.

23 July 2024 relevance

The indexation benefit has been removed for all capital assets, except property, after 23 July 2024. For land or buildings purchased before 23 July 2024, one can choose from LTCG tax of 12.5% without indexation or 20% with indexation, but for property purchased after this date, only 12.5% tax will be levied without indexation.

With each passing year, the cost of goods and services keeps increasing due to inflation. This reduces the purchasing power of money, which means that one can buy fewer things with the same amount of money. Cost inflation index is a tool, defined under Section 48 of the Income Tax Act, 1961, that helps measure the rise in cost due to inflation. It does so by assigning an index figure for each year.

The base year considered for the index is 2001-2, for which the figure is 100. All subsequent years’ index figure is calculated with respect to 100. The Central Board of Direct Taxes (CBDT) notifies this figure each year and publishes it in the official gazette. For 2025-26, the CBDT has notified the CII figure as 376.

What is it used for?

This index is used in taxation to avail of the indexation benefit. This means that while calculating the long-term capital gains, the purchase price of assets is increased to keep it in line with inflation. This reduces the gains and, thereby, the tax liability.

For instance, if you bought a house in 2003 for Rs.5 lakh and sold it in 2022 for Rs.20 lakh, here’s how you can calculate your long-term gain with and without indexation. For LTCG with indexation, you will first have to calculate the indexed cost of buying the property by using the following formula.

23 July 2024 relevance

The indexation benefit has been removed for all capital assets, except property, after 23 July 2024. For land or buildings purchased before 23 July 2024, one can choose from LTCG tax of 12.5% without indexation or 20% with indexation, but for property purchased after this date, only 12.5% tax will be levied without indexation.

You may also like

FIFA 'consider scrapping penalty rebounds' and two more radical changes at 2026 World Cup

Stranger Things fans 'work out' iconic guest star's role as they predict major showdown

Rahul Gandhi, Mallikarjun Kharge write to PM for Jammu and Kashmir statehood; CM Omar Abdullah welcomes move

Olympic medalist skier dies after being struck by lighning as tributes pour in

EastEnders' Phil Mitchell faces worrying triple setback following mental health storyline