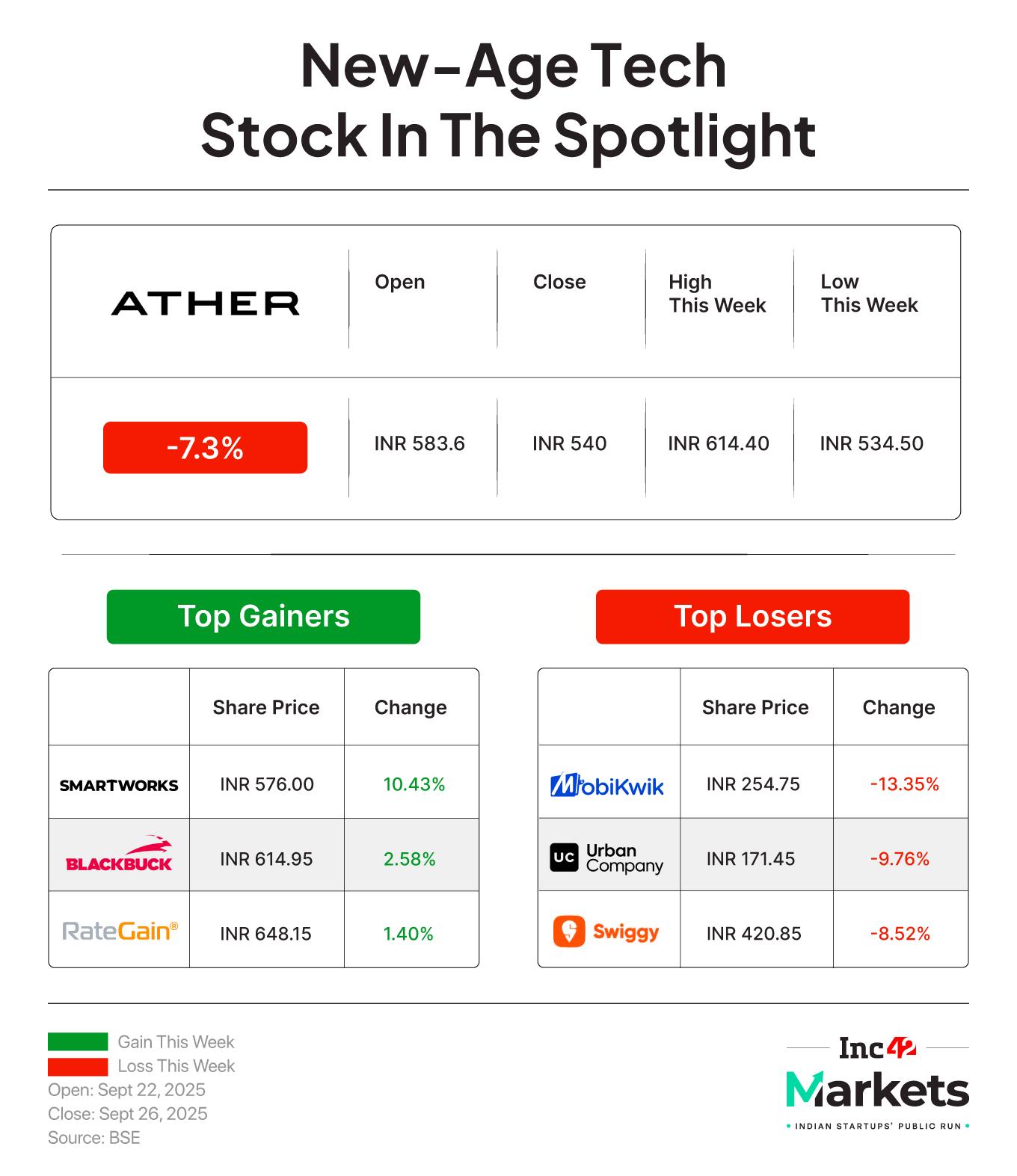

Do you hear whispers on Urban Company resonating down Dalal Street? It’s been two weeks since it went listed at a hefty premium of 56.3% on the issue price, but the hottest IPO of the year, which was overbought 104 times, didn’t cease to woo traders.

Urban Company, which was listed at INR 161 a share on the BSE, joined the league of Ather Energy, IndiQube, Smartworks, BlueStone, DevX and ArisInfra – all making their debut in the markets this year and signalled a clear appetite among investors for new-age businesses.

The success of Urban Company has instilled fresh momentum into India’s tech IPO pipeline.

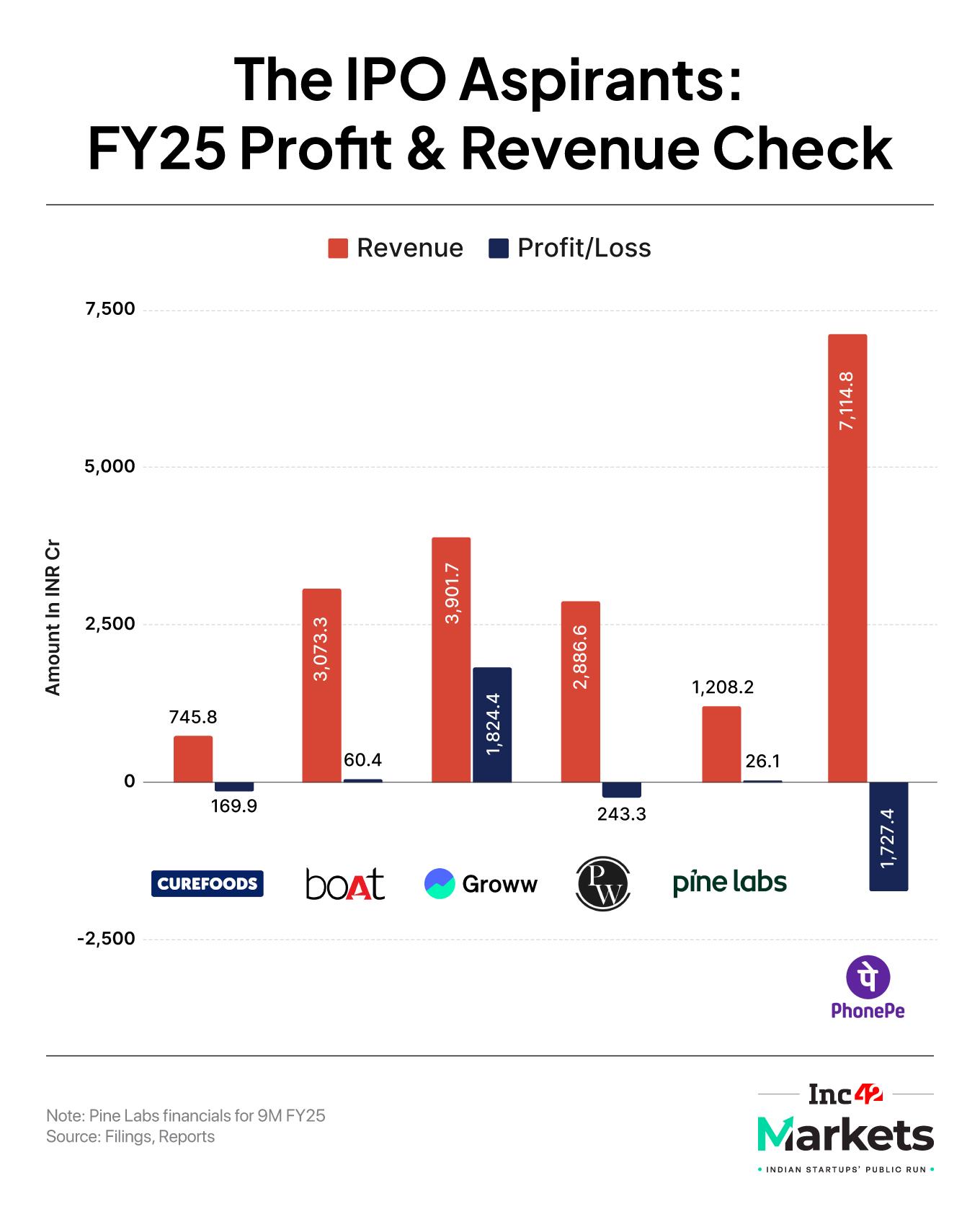

The upcoming IPO lineup looks compelling: PhysicsWallah, Groww, PhonePe, boAt, Pine Labs and Curefoods are waiting in the queue.

PhonePe is looking to steal the spotlight as it gears up for an INR 12,000 Cr IPO around the middle of 2026, promising a watershed moment for India’s fintech landscape. A blockbuster listing of the payments giant, which has 46% share of the UPI market and is backed by US retail major Walmart, may open the floodgates for more fintech floats.

PhysicsWallah, on its part, is laying out an INR 3,820 Cr public issue. Its listing will be an acid test for investors on the edtech platform, which is still recovering from the BYJU’S meltdown.

Given the backdrop, investor enthusiasm is tempered with caution. Following mixed outcomes from earlier tech listings, such as Paytm’s, the spotlight is now firmly on consumer-facing companies with proven business models and clear profitability roadmaps.

What’s Working For New IPOs AKA Winning Investor TrustWith another IPO wave approaching, investors are watching closely to see how much the market has evolved since Paytm’s 2021 listing.

The startup funding boom that followed brought layoffs, shutdowns, and a sobering reality check. Investors have clearly moved on from the growth-at-all-costs mindset, driving the focus on profitability and sustainable expansion – a change that has proven to be a boon for late-stage companies planning to go public.

“Profitability has become central. In fact, 60% of companies that went public in Q1 of 2025 were profitable – up sharply from 2024. Metrics like the Rule of 40 are now widely applied,” said Gaurav Garg, research analyst at PeepalCo’s investment tech platform Lemonn and former Deloitte exec.

The Rule of 40 is a benchmark where the combined total of a company’s revenue growth rate and profit margin must reach 40% or more. It’s typically used for SaaS companies, but is applicable in some ways for publicly listed companies too.

While the US public markets continue to embrace IPOs regardless of profitability, India throws up a striking contrast.

“The US remains a gusher of capital, where markets are willing to pay a significant premium for the promise of future growth,” said wealth management platform NAV Capital’s MD Vineet Arora. “India has a relatively smaller pool of capital, and investors here are far less forgiving. They reward companies that show profitability, not those still burning cash.”

The experience of India’s early tech IPOs, where the initial euphoria quickly gave way to sharp corrections, has reinforced this lesson. Growth and profitability go hand-in-hand, but in India, profitability takes priority.

This has also changed the way investors evaluate companies. Revenue is no longer the primary concern; the emphasis is on operating profit.

Over the past few quarters, the muted growth in tech stocks has largely been due to companies prioritising efficiency and improving EBITDA, a metric that is much tougher to move. When operating losses shrink and margins improve, markets gain confidence that companies are managing resources effectively, Simranjeet Singh Bhatia, senior research analyst at Equity Almondz Global, added.

Cash burn is another key consideration. Companies that can manage their expenses and generate positive cash flow while pursuing expansion send a strong message to investors. At the same time, expansion plans – be it opening retail outlets or scaling operations – are also scrutinised closely, he added. A strong balance sheet helps chase growth, even for a young company.

The primary market at the moment is supportive, but it is not without its challenges. Recent SEBI reforms have made a real difference for companies looking to list. Simplified ESOP norms and relaxed promoter requirements have removed some of the hurdles that used to complicate the IPO processes.

Plus, the rollout of GST 2.0 has also infused some optimism for consumer-focussed issues. Investor participation in recent months should give startups plenty of courage to go bigger, but one must also point out that IPO-bound startup valuations are not secure.

Foreign institutional investors (FIIs) are driving demand through strong anchor participation in IPOs, but have been more selective in terms of secondaries in the equities market. There’s a clear preference for early IPO valuations over post-listing gains, according to Lemonn’s Garg, which is a net positive for IPO-bound companies.

At the same time, the domestic institutions emerging as stabilisers have cushioned the volatility from foreign outflows. The result is a healthier IPO environment, which tech companies crave. However, unicorns such as Groww, PW, Pine Labs and PhonePe will go through some valuation pain either during the listing or after listing.

While some of these companies may justify their valuations in the long term, a short-term downturn in valuations can be expected around the IPO. Many might also adjust their expectations of the market closer to the IPO date. But overall, there’s great enthusiasm about the appetite for new-age IPOs.

Consumer Startups Hold The EdgeB2C startups are naturally easier for investors to understand and track, as these are recognisable brands and have plenty of coverage and benchmarks around.

Demographics and growing digital adoption across consumer and market segments further amplify the appeal of consumer tech, in particular brands that have built their names over the past decade. This paves the way for B2C and consumer tech businesses to prosper with more and more participation from retail investors who are their end consumers.

Unlike complex enterprise models, their metrics are tangible and relatable such as user base, transaction volume, retention rate, and acquisition costs. Investors get more clarity on how the business is performing.

Which brings us back to Urban Company’s IPO success. Those we spoke to believe the massive premium was driven largely by strong brand recognition and a business model that people could grasp at ease.

Similarly, strong recall will also be crucial in this wave of IPOs as brands like PhonePe and PhysicsWallah enjoy real traction with proven consumer appeal. PhonePe, in particular, will be an intriguing watch given the competitive dynamics with Paytm.

The market is also waiting to see a host of big-ticket IPOs being rolled out. The upcoming issues of Reliance Jio, Meesho, Tata Capital and Zepto have stoked investor enthusiasm for consumer-facing and tech-driven businesses.

The macro picture, however, isn’t without glitches. Rates are still on the higher side, markets are jittery with the volatility index hovering above 20, and global uncertainties – from US trade tensions to geopolitical shifts – often dampen the investor sentiment.

While the mood right now is bullish, it would be folly to dismiss potential headwinds such as the geopolitical shifts and the impact of AI on critical sectors. But for the next few months at least, the IPO buzz will ring true and loud.

Markets Watch: Upcoming Issues, Results & More

-

- Zappfresh IPO Gets Slow Start: The BSE SME IPO of meat delivery firm Zappfresh saw a tepid response, with just 21% subscription on its first day of bidding with subscriptions set to continue this week

- Nazara Shares Trade Ex-Bonus, Ex-Split: After approving a 1:1 bonus issue and stock split, Nazara’s shares closed the previous week at INR 280.55 after opening last Monday at INR 1,091.90

- Purple Style Labs Files DRHP For IPO: Purple Style Labs, parent of Pernia’s Pop Up Shop, has filed its DRHP with SEBI for an IPO comprising only a fresh issue of equity shares

- PhonePe Pre-Files DRHP With SEBI: Walmart-owned fintech major has reportedly pre-filed its DRHP with SEBI, aiming to raise about $1.5 Bn at a valuation of up to $8 Bn

- Swiggy Sells Rapido Stake: Swiggy has approved the sale of its stake in ride-hailing and food delivery startup Rapido to existing investors Westbridge and Prosus for approximately INR 2,400 Cr

[Edited by Nikhil Subramaniam]

The post Groww, PhonePe, PhysicsWallah And A New Era Of Startup IPOs appeared first on Inc42 Media.

You may also like

Inside Soap Awards winners in full as Coronation Street takes home major gong

Pandit Deendayal Seva Pratishthan stands as true symbol of integral humanism and 'Antyodaya': Maha CM

One berry, multiple health benefits: This low calorie fruit could be the underdog superfood you need

Cyber fraud case: ED seizes properties after raids in J&K's Ganderbal district

Gujarat CM highlights GST reforms as key to achieving Viksit Bharat Vision and boosting local manufacturing