Caught in a top-deck turmoil, fintech startup Lendingkart’s NBFC arm Lendingkart Finance slipped into the red in FY25 due to a rise in impairment costs and decline in its top line.

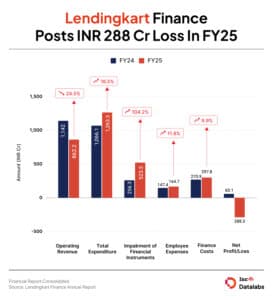

The Ahmedabad-based NBFC incurred a net loss of INR 288.3 Cr during the year as against a net profit of INR 60.1 Cr in the previous fiscal year. Operating revenue declined 24.5% to INR 862.2 Cr in FY25 from INR 1,142 Cr in the previous fiscal year. Including other income, total revenue stood at INR 867 Cr, a decrease of 24.4% from INR 1,146.4 Cr.

It is pertinent to note that Lendingkart Finance first achieved profitability in FY23, when it reported a net profit of INR 118.8 Cr for the year. Its profit declined 97.2% YoY in FY24.

Lendingkart Finance is a subsidiary of fintech startup Lendingkart Technologies.

Lendingkart’s Top Deck ReshuffleLendingkart Finance’s founder Harshvardhan Lunia stepped down from his role as managing director, effective June 30.

Responding to Inc42’s queries, a spokesperson of Lendingkart Finance said, “Harshvardhan Lunia’s term as the managing director of Lendingkart Finance Limited, wholly-owned subsidiary company of Lendingkart Technologies Pvt Ltd, expired on June 30. The company is in the process of appointing the managing director and requisite announcement will be made shortly.”

Notably, the company’s second cofounder, COO Mukul Sachan, departed from the NBFC in 2019. He was the CEO of Lendingkart Finance between 2017 and 2019, after which Lunia took over.

Lunia’s exit comes at a time when the Lendingkart Group has seen the exit of multiple senior executives over the past year.

As per a report by The Morning Context, the Lendingkart Group saw at least eight top executives resign in the past year.

The top-level exodus largely began after Temasek-owned Fullerton Financial Holdings (FFH) acquired a majority stake in Lendingkart Technologies in October 2024 by infusing INR 252 Cr in the startup. In March this year, the RBI approved the transaction.

Journey Of Lendingkart So FarLunia and Sachan founded Lendingkart Technologies in 2014 to offer unsecured business loans to MSMEs by leveraging technology and data analytics.

Besides Lendingkart Finance, Lendingkart Technologies has one more subsidiary – Upwards Fintech Services. Set up in 2017, Upwards Fintech offers unsecured personal loans to salaried individuals. Lendingkart Technologies had one more subsidiary, Finectar Technologies, which was struck off in July 2024.

In May, Inc42 reported that the lending tech platform was set to raise INR 100 Cr (around $11.7 Mn) in venture debt from InnoVen Capital.

The startup has raised over $370 Mn in funding since its inception. It counts Stride Ventures, BlueOrchard, Yubi, among others, as its investors.

Post the majority stake acquisition by FFH, Lunia stepped down from his role as chief executive of Lendingkart Technologies. He was succeeded by DBS Bank’s former managing director and head of consumer banking group Prashant Joshi in April this year.

RBI’s Whip On Unsecured Loan OfferingsA sharp rise in unsecured lending by Indian banks and fintech companies resulted in the central bank tightening lending norms in late 2023 by increasing the risk weight for consumer credit exposure of banks and NBFCs.

In simple terms, this was expected to drive the lending costs higher for unsecured consumer loans.

This negatively impacted lending platforms such as Lendingkart Finance. Earlier this year, in an interview with Inc42, Lunia reasoned that the 97% decline in FY24 profit was caused by rising staffing costs, increase in credit expenses and fees associated with portfolio renewals and new registrations under credit-guaranteed schemes.

Lunia also said that FY25 profit would take a hit due to a drop in the top line due to shrinking AUM, rising costs of funds amid stricter RBI policies and broader macroeconomic pressures.

Zooming Into Lendingkart Finance’s Expenses

For the financial year ending March 2025, Lendingkart Finance’s expenses soared 18.5% to INR 1,263.5 Cr from INR 1,066.1 Cr in the previous year. Among its various costs, the following have been marked as its highest spending for the year:

Impairment Of Financial Instruments: Impairment loss refers to a financial asset such as a loan or investment, that is unlikely to be fully recovered. At INR 523.5 Cr, this accounted for 41.4% of the overall expenses for FY25. The spending under this bucket more than doubled from INR 256.3 Cr in FY24.

Employee Benefit Expenses: Employee costs, which include salaries, provident fund, gratuity, among others, surged 11.8% to INR 164.7 Cr in the reported year from INR 147.4 Cr in FY24.

Finance Costs: The NBFC’s finance cost stood at INR 297.8 Cr in FY25, up almost 10% from INR 270.9 Cr from the previous year.

The post Lendingkart Finance Slips Into Red, Posts INR 288 Cr Loss In FY25 appeared first on Inc42 Media.

You may also like

Alex Horne exposes Greg Davies' true colours with remark about Taskmaster co-star

Add 1 ingredient to chicken pie to make it 'utter heaven'

Flowers will stay fresh for longer with '45-degree angle' hack

Video song 'Aagasa Veeran' from Vijay Sethupathi's 'Thalaivan Thalaivi' released

S Club TV star unrecognisable 25 years after hosting alongside Holly Willoughby